Republic is a recently released startup investing platform. It’s an offshoot of the popular AngelList crowdfunding platform. The goal with this particular platform is to take the Silicon Valley successes that AngelList has helped to achieve and make it more accessible for SMEs and small investors who don’t meet the very tight vetting standards of the original platform.

Essentially, any business can apply for funds, and any type or level of investor can help fund the businesses they believe in. Even regular folks with a few bucks they want to invest can sign up on Republic and choose an investment they believe in.

This is what makes the crowdfunding platform attractive to both investor and investee; the fact that you don’t have to be an angel or VC to invest, nor do you need to be a startup with a billion dollar proven concept to get funded.

Republic by AngelList

Built Small for Small Business

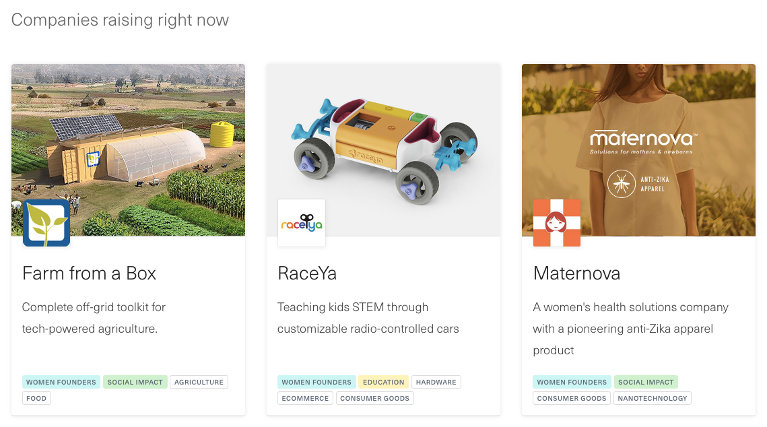

There are, of course, standards that Republic expects the companies seeking funds to adhere to, but the platform shows promise so far in their mission to bring startups outside of Silicon Valley closer to the funds they need to grow and succeed. They allow companies to seek up to $1-million in funds total throughout the calendar year, meaning you’re not going to find very many hungry VC sharks circling you looking to take a massive chunk of your fledgling company – not yet anyhow.

The basic core criteria Republic and their staff expect is quite reasonable:

- The company seeking funds cannot have been convicted of fraud, securities violations or any other serious crime.

- The company has not sought more than $1-million in the last year (this includes all crowdfunding campaigns, from all sources).

- The company operates within and is registered in the United States and has plans to expand operations using the crowd-sourced funds they’re seeking.

Some of Republic’s non “core” values are shown below. These soft factors are considered on a per-application basis:

- Experience of founders and management team is second-to-none.

- Excellent products, services and market opportunities available.

- Revenue and growth trending in a positive manner prior to application.

- Customer base and demographics are in line for continued growth.

- Fundraising needs are in line with Republic’s rules and regulations.

- Offering terms that also are in line with Republic’s and those of the SEC.

- Business plan has all the T’s crossed and I’s dotted.

- Financial health of the company has a positive outlook.

- Record keeping procedures are in place, and can pass Republic’s crowdfunding application audit.

Failing one, or even many, may not necessarily mean a rejection, but obviously there are some that are more important than others (ie., not throwing up red flags with the SEC!)

After your application to seek funds on Republic has been accepted, you’ll need to make sure you have a lawyer and a transfer agent on board, as well as a CIK so you can file a Form C with the SEC (ie., SEC filing code number). You can apply for EDGAR access and get your CIK here.

Reasonable Fees

This is one area that an SME owner might find a little intimidated. The fees and total cost to close a funding deal are very real. If you’ve never sought funds for a company before, keep in mind that you never get to keep everything you raise, and you’ll have to raise a small seed fund before committing, in order to handle the costs involved in applying, closing, and then later transferring the funds successfully into a company account.

- Republic Commission: They collect 5% of the money raised and 2% of all securities.

- iDisclose Partner Fees: iDisclose helps you file your Form C with the SEC. You’ll pay them $2500 upfront to do so.

- Legal and other costs: Republic estimates your legal costs to likely start at $10,000 and go up from there depending on your funding needs and any unique circumstances.

Not all Businesses will get their Funding

Like most goal-based crowdfunding platforms, Republic expects you to set a target, and meet or exceed it. If your campaign doesn’t meet its targets, investors get their money back and your company doesn’t receive any funds.

This is the chance all businesses have to take when it comes to crowdfunding, which is why it’s so important to make sure crowdfunding your business is the right move before starting the process.

If you have any more questions, or want to post a campaign to get your business funded, you can contact Republic here.