Angel investing is fascinating and can be lucrative, but not many quite understand how to get into the world of angel investing; even if they do, they have no idea how to do it properly. That’s a pity, really – considering the wealth of investing opportunities available for angels.

If you happen to read this during your search for angel investing information, well, you’re in luck – because in Funding Note’s Second Episode of Expert Q&A, we feature Shannon Wu, who is an angel investor on various fast-growing startups and have worked with numerous startups.

Without further adieu, here’s the Q&A interview – enjoy!

Hi, Shannon, please kindly introduce yourself to our readers.

Hi, Funding Note! Thanks for inviting me.

I’m a strategist, advisor and angel investor in fast growing startups. I formerly served as the Director of Marketing for FOUNDER.org, an early-stage investor and company building program for young innovators. I had the pleasure of working with an absolutely incredible team that was providing investment, education and support for young entrepreneurs building world-changing companies.

Now, I run a boutique digital innovation shop called Mr. Progress. We help high-growth technology companies with acquisition strategy and go-to-market consulting. Over the past few years, I’ve consulted for over 100 companies ranging from large brands to tiny startups.

You’ve seen and worked with numerous startups. What is one common issue that your early-stage clients have to deal with?

Two things come up time and time again.

First, early stage startups consistently mistime their launches. I see some startups with complete products spending months worrying about their go-to-market, only to let a competitor capture their users while they fall behind. On the other hand, I see startups release a half-baked product and burn the relationships with their early adopters. Obviously, getting to market is important, but getting to market with a well-timed launch is absolutely critical.

The second issue I see is startups sometimes do not understand who will use their product. They have no target customer in mind and, as a result, have no way to acquire users. These founders have the mentality that “if you build it, they will come”, which almost always is not the case. I advise founders to look at trends and find out exactly who their competitors are targeting. You’d be amazed how much market research can show- you can essentially get a roadmap of exactly how to acquire new customers and users. Some free tools I tell startups to use are Google Keyword Tool, SpyFu, SemRush and Google Keyword Trends.

You are also an angel investor. Which startups have you invested in? What are you looking for in a startup that interests you in investing in them?

Haha – well, every angel investor is going to say this, but I’m looking for promising, early stage companies with big growth potential. In particular, I enjoy investing in companies where I can add significant value, either through connections or strategy.

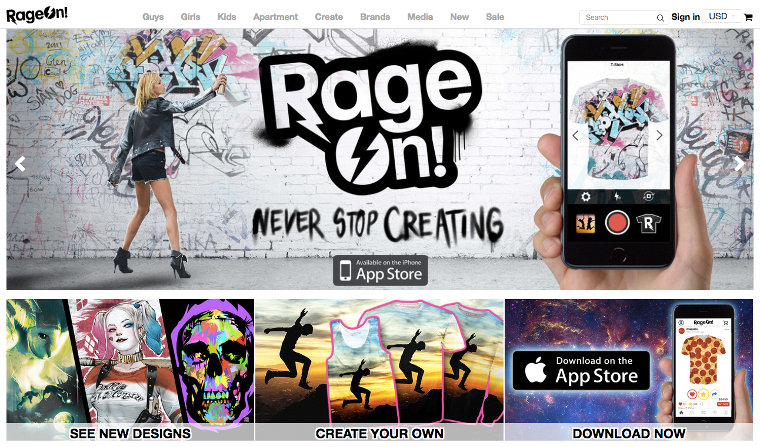

One company I invested in earlier this year, RageOn, is an e-commerce marketplace that has been seeing tremendous growth. What really closed the deal for me was the founder’s impressive ability to create large-scale partnerships with some of the world’s largest brands. His dedication was impressive.

If you had to choose, what’s your priority in investing: The product or the founder?

A company cannot be successful without both a great founding team and a great product, but if I had to pick one… founder.

Let’s put it this way: Any way you slice it, an amazing product cannot succeed with an incompetent team. However, a great founder has a better chance of problem solving their way through challenges. They will find a way to make it great. The best founders are quick, thoughtful, resourceful, gritty and strategic. When great founders are working on building incredible products, that’s when the magic happens.

In my humble opinion, diversity is an issue in the startup funding world – what should female founders and funders do to break through in the male-dominated sector?

Just keep on doing what you’re doing! Keep envisioning, building and funding incredible companies. The startup world already has incredible female founders like Dinae Ringleman of Indiegogo, Robin Chase of Zipcar, Anne Wojicki of 23andMe, and Adi Tatarko of Houzz. And we also have excellent female investors like Rebecca Lynn of Canvas Ventures, Theresa Gouw of Aspect Ventures, Ann Lamont of Oak Investment Partners, Kristen Green and Eurie Kim of Forerunner Ventures. Now we just need more of them!

Yes, Silicon Valley absolutely needs more diverse representation. But I believe that, without a doubt, we are going to be seeing more and more all-star teams of all diverse backgrounds: region, race, gender, socio-economic class, experiences.

Angel investing vs. VC – which one should a startup choose for funding its operations?

It really depends on the stage of the company and the amount you are raising.

In the earliest days, you would almost exclusively raise your seed round from angels or accelerators. For the majority of companies, it’s almost impossible to raise your first dollar from institutional VCs.

Angel investors vary from high-net worth individuals, to professional angel investors with a fund, to friends who really believe in your company. Angels typically write between $50,000 – $500,000 size checks. As the company grows, you may seek out larger fundraising rounds from an institutional investor- that’s when it primarily makes sense to start raising venture capital.

I’m interested in angel investing – what’s your advice for a first-time angel investor like me?

Be patient. Understand that the angel investing is very risky and it’s not a “get rich quick” play. No matter what the company looks like in the early stage, getting a return is rare. Don’t invest more than you plan to lose.

If you decide to invest, examine, evaluate and learn from at least a thousand early stage companies before writing your very first check. Not only do you need to know what good looks like, you need to have patience for the right investment opportunity. It takes time, but it’s exhilarating finding the rare mix: a ripe market opening, a smart solution, the right team to take it to market, and the right timing to invest. Too early and you might be making too risky a bet- too late and your check might not move the needle for the company or your portfolio.

Please share your tips on how to secure funding for our readers who are startup founders.

Build out your network of advocates. There’s no better signal for investors than when other people stick their necks out for you. It’s a very relationships based system. The best advice I can give is to start building out those relationships early. And I’m talking real relationships, not the superficial kind where the very first interaction is to ask for money.